How Esg can Save You Time, Stress, and Money.

Wiki Article

All About Esg Technology

Table of ContentsThe Only Guide for EsgThe Esg Sustainability Diaries4 Easy Facts About Esg Strategy ShownEsg - Questions

Why do particular financial investments perform far better than others? Why do certain startups seem to always surpass and get ahead of the cohort? The answer has 3 letters, as well as it is Whether you are a financier or a business, big or little - Environmental, Social and also Administration (ESG) coverage and investing, is the structure to capture on if you desire to remain up to speed up with the market (and also your expense) - ESG Sustainability.Now, allow's study the ESG topic as well as the wonderful significance that it has for companies as well as investors. To assist capitalists, banks, as well as business understand much better the underlying criteria to apply and also report on them, we made a. Download and install the type listed below and also access this special ESG source totally free.

Financiers want to recognize if they can trust the business and also what sort of decisions are taken behind shut doors. It consists of executive pay, sex equity/ equivalent pay, bribery and also corruption, and also board diversity. The method of ESG investing began in the 1960s. ESG investing progressed from socially liable investing (SRI), which omitted supplies or entire industries from financial investments connected to service procedures such as tobacco, guns, or products from conflicted regions.

Components of it are efficient from March 2021. The purpose is to reorient funding flows towards sustainable financial investment and also away from markets adding to climate modification, such as fossil fuels.: is perhaps the most enthusiastic message aiming to provide a non-financial general score covering all facets of sustainability, from ESG to biodiversity as well as pollution treatment.

Not known Factual Statements About Esg Technology

You instead leap on this train if you do not want to be left behind. There is a boosting awareness that. For companies to remain ahead of policies, competitors and release all the advantages of ESG, they have to incorporate this framework at the core of their DNA. In another perspective, to manage regulatory, lawful or reputation concerns at a later stage.

(ESG) issues are playing an increasing role in firms' decisions around mergings, home purchases, as well as divestitures. Just how do these aspects connect to business performance and deal prospective? They spoke with Approach & Corporate Financing communications supervisor Sean Brown at the European 2020 M&A Conference in London, which was held by Mc, Kinsey and also Goldman Sachs.

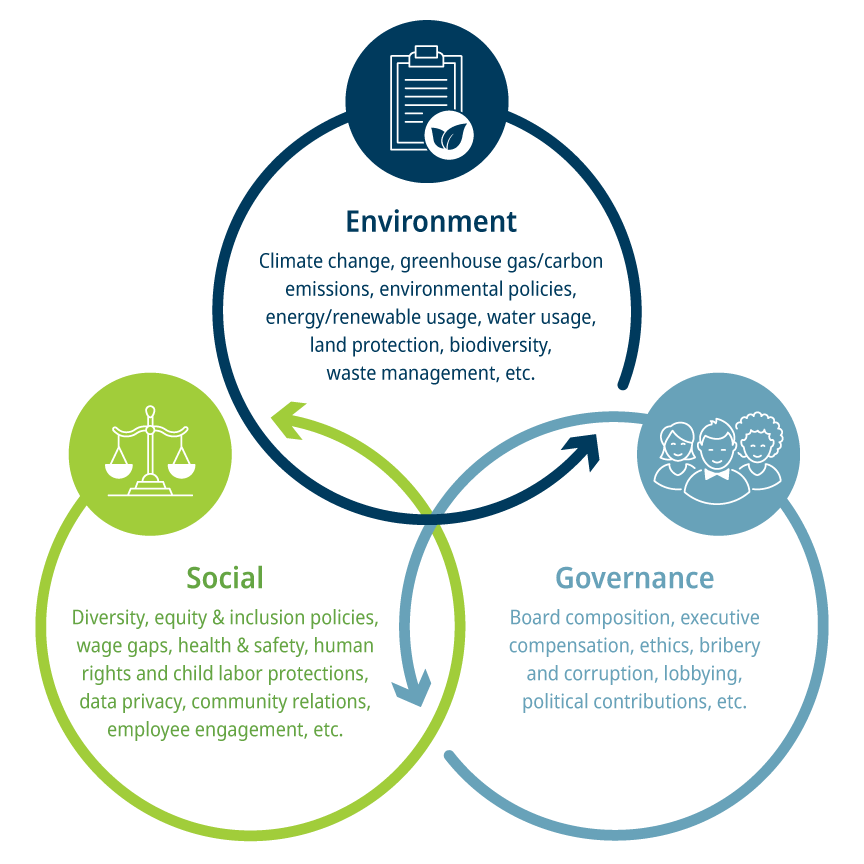

For more conversations on the technique problems that matter, subscribe to the series on Apple Podcasts or Google Play - ESG Investing. Audio Why ESG is below to remain Sara, could you start by explaining what ESG is and why it has increased in importance in M&A? ESG is rather a wide collection of problems, from the carbon dioxide impact to labor practices to corruption.

6 Simple Techniques For Esg Sustainability

Why are those 3 concerns grouped together when they are so significantly different? They link with each other in the feeling that the environment, the social factors, and also the degree to which you have great governance influence your certificate to run as a company within the external globe. To what extent do you manage look at this now your ecological impact? To what extent do you boost variety? To what extent are you transparent in your contributions to a country? That has an influence on your permit to run in the minds of the stakeholders around you: regulatory authorities, governments, and also significantly, NGOs powered by social media sites.Customers are currently demanding high criteria of sustainability as well as high quality of work from companies. Regulators as well as plan manufacturers are much more interested in ESG due to the fact that they need the company field to help them resolve social troubles such as ecological air pollution and workplace diversity (ESG Investing). The investor community has actually additionally come to be a lot more interested.

What are some of the key aspects on which ESG scores have an influence? The initial question you need to respond to is, to what extent does great ESG convert right into great monetary efficiency?

Things about Esg Strategy

Proof is arising that a much better ESG rating equates to regarding a 10 percent reduced expense of capital as the threats that affect your company, in terms of its permit to operate, are reduced if you have a strong ESG proposal. Proof is arising that a better ESG score converts to about a 10 percent lower cost of funding, as the risks that impact your company are minimized.Report this wiki page